Market update Q3 2025

After months of anticipation, the third quarter finally delivered the alignment that Q2 had only hinted at: policy clarity, a friendlier macro backdrop, and deepening institutional demand all began to reinforce one another. The regulatory groundwork laid earlier in the year began to bear fruit, monetary policy turned decisively supportive, and liquidity met conviction for the first time in this cycle. What began as cautious optimism evolved into confidence as these forces converged to ignite the strongest rally of the year thus far. At first, markets still seemed to be searching for direction, but by mid-summer momentum had returned, reminding investors how quickly conviction can rebuild once clarity and capital move in tandem.

The summer rally

The quarter opened with markets still negotiating an uneasy balance between optimism and caution. The White House’s renewed tariff threats kept investors alert, but the pattern was by now predictable—the “TACO trade,” short for “Trump Always Chickens Out,” in which each round of President Trump’s brinkmanship ended with compromise and another rally in risk assets, was a cycle investors had learned to front-run. Even with the August 1st deadline still looming and major trade deals unresolved, equities pressed to fresh all-time highs week after week. Gains were propelled by a resilient earnings season and the still-potent AI narrative, though breadth remained narrow and leadership concentrated in mega-cap technology.

Crypto, meanwhile, entered the quarter tentatively. Bitcoin alone carried the underlying bid, supported by steady ETF inflows and its appeal as a hedge against monetary debasement that had carried over from June, while altcoins remained the laggards amid uncertainty over the policy and macro path. That clarity arrived mid-month, and with it, a catalyst that redefined the market’s trajectory. Within days, Congress passed three landmark bills—the GENIUS Stablecoin Act, the CLARITY Act, and the CBDC Anti-Surveillance Act—which together created the first comprehensive federal framework for stablecoins, custody, and digital-asset issuance. For institutions long constrained by regulatory ambiguity, Washington sent an unmistakable signal that crypto had entered the financial mainstream. Stablecoins gained legal recognition as dollar-backed payment instruments, exchanges obtained clear licensing paths, and banks were granted authority to provide settlement and custody.

These policy breakthroughs also coincided with a softer macro backdrop that helped broaden the rally beyond Bitcoin. Labour market data signalled the first signs of cooling, inflation prints eased, and July’s FOMC minutes confirmed that the Fed’s next move in September would likely be a cut. This combination of policy clarity and a dovish macro backdrop ignited a decisive rotation into Ethereum, which became the unquestioned power engine of the entire summer. Importantly, the rally was largely anticipatory, driven more by front-running than by any material change in Ethereum’s fundamentals or network metrics. It reflected Ethereum’s position as the most established and institutionally ready infrastructure capable of absorbing the first wave of policy-driven inflows. Its ETFs drew more than $5 billion of net inflows during the month—overtaking Bitcoin for the first time—and its rally through $3,000 lifted the broader market, setting off the first sustained rotation into high-quality altcoins since the April lows. Capital particularly flowed toward Ethereum-based projects that combined genuine traction and a clear fit with the institutional narrative—among notable names, Maple Finance, with its institutional DeFi credit markets, and Ethena, whose synthetic-dollar model captured surging demand for stablecoin exposure within a compliant framework.

Alongside ETFs, digital-asset treasuries (DATs) emerged as the other defining institutional force of the summer. These listed corporate vehicles, created solely to accumulate crypto exposure, rapidly became magnets for traditional allocators and a new pillar of demand across majors and quality altcoins. What began as an ETF-driven rally evolved into a cycle supported by a dual channel of persistent flow.

By late July, the macro clouds that had shadowed earlier months seemed to have cleared. Breakthrough trade deals with Japan, South Korea, and the EU dissolved tariff risks and boosted U.S. investment commitments, extending the rally into August. Yet as positioning stretched and valuations rose, the first cracks appeared when a hotter-than-expected inflation print at month-end reignited debate over the Fed’s future path. This sparked profit-taking across the crypto market after a month of exceptional gains and marked the summer’s first meaningful pullback.

And August carried those cross-currents forward. The market remained supported by consistent and deep inflows, particularly into Ethereum- and Solana-linked vehicles, yet the macro backdrop was growing more unsettled. Equities, after months of almost uninterrupted gains, faced mounting concern over overextension, with valuations increasingly pinned to the expectation that the Fed would deliver a September cut. Consequently, every data release had the potential to disturb that delicate balance at historically elevated valuations. The inflation picture grew contradictory: a firmer CPI reading reignited concern that policy might remain tighter for longer, only for a softer PPI to reassure investors that easing was still on track in the same week. As the labour market simultaneously showed signs of cooling, the resulting cross-winds led to a constant repricing of the cut’s probability, which whipsawed bond yields, equities, and particularly higher-beta expressions of risk appetite in crypto.

Through the volatility, the underlying bid in digital assets held firm but grew noticeably more selective. ETF and DAT inflows continued to provide a durable foundation, keeping Ethereum and its beta complex at the centre of market leadership, while the bid began to extend outward to other ecosystems that showed comparably strong fundamentals. Activity and capital rotated into Solana and Base, where on-chain volumes, user retention, and revenue traction pointed to genuine adoption rather than speculative churn. Particularly telling was the pattern of recoveries: assets with real revenues, visible growth, and credible token value accrual were the first to find support, while high-issuance or purely narrative-driven tokens struggled to regain footing.

Digital asset treasuries: the reflexive engine of the rally

Among the summer’s institutional forces, none were more transformative than digital-asset treasuries (DATs). While ETFs laid the groundwork for adoption, DATs undoubtedly provided the accelerant. By turning corporate balance sheets into gateways for crypto exposure, they expanded the universe of investable assets on public markets and hard-wired a powerful reflexive loop into the market’s structure.

Functionally, DATs raise capital through traditional equity or debt issuance—often via public offerings, at-the-market programs, or structured financing—with the sole mandate of deploying those proceeds into digital assets. Some supplement this with derivative or yield strategies once their holdings are established, but the core dynamic remains the same: new capital begets new crypto demand. The idea is not novel; gold trusts, REITs, and other closed-end funds have long offered analogous vehicles for accumulating exposure to scarce assets in traditional finance. What sets DATs apart, however, is the nature of the market into which this buying power flows. Crypto is inherently more reflexive: it trades continuously, moves across borders with minimal friction, and responds to shifts in sentiment almost instantaneously. Thus, when DATs trade at premiums to the value of their underlying reserves (i.e., mNAV), they can issue new shares at those elevated prices and use the proceeds to purchase additional tokens. Because crypto markets trade continuously and issuance programs can operate with minimal friction, this reflexive loop has the potential to unfold far faster than in traditional closed-end structures, reinforcing both DAT valuations and the broader market in real time.

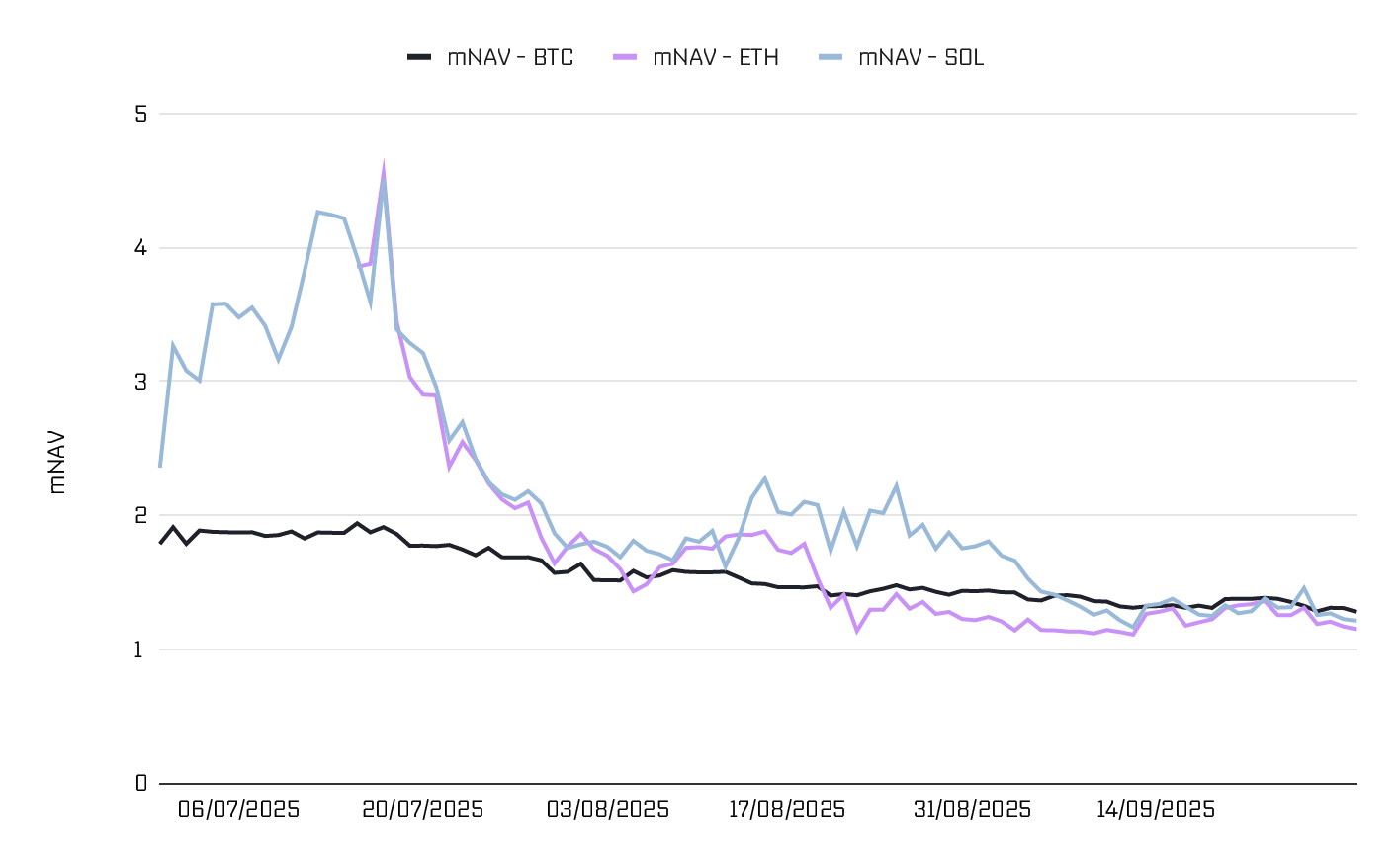

Through the summer, that mechanism operated at full throttle. At the height of July’s rally, the largest DATs’ mNAV premiums averaged between 20% and 35% and occasionally pushed beyond 40%, reflecting insatiable demand for listed exposure. While Bitcoin-focused treasuries dominated the first generation of these vehicles in prior quarters, this cycle was led by Ethereum. New entrants extended the model to Solana, and a handful even reached high-conviction altcoins such as Ethena, Hyperliquid, and Binance’s governance token—signalling that the investable architecture of the market was beginning to stretch beyond the majors.

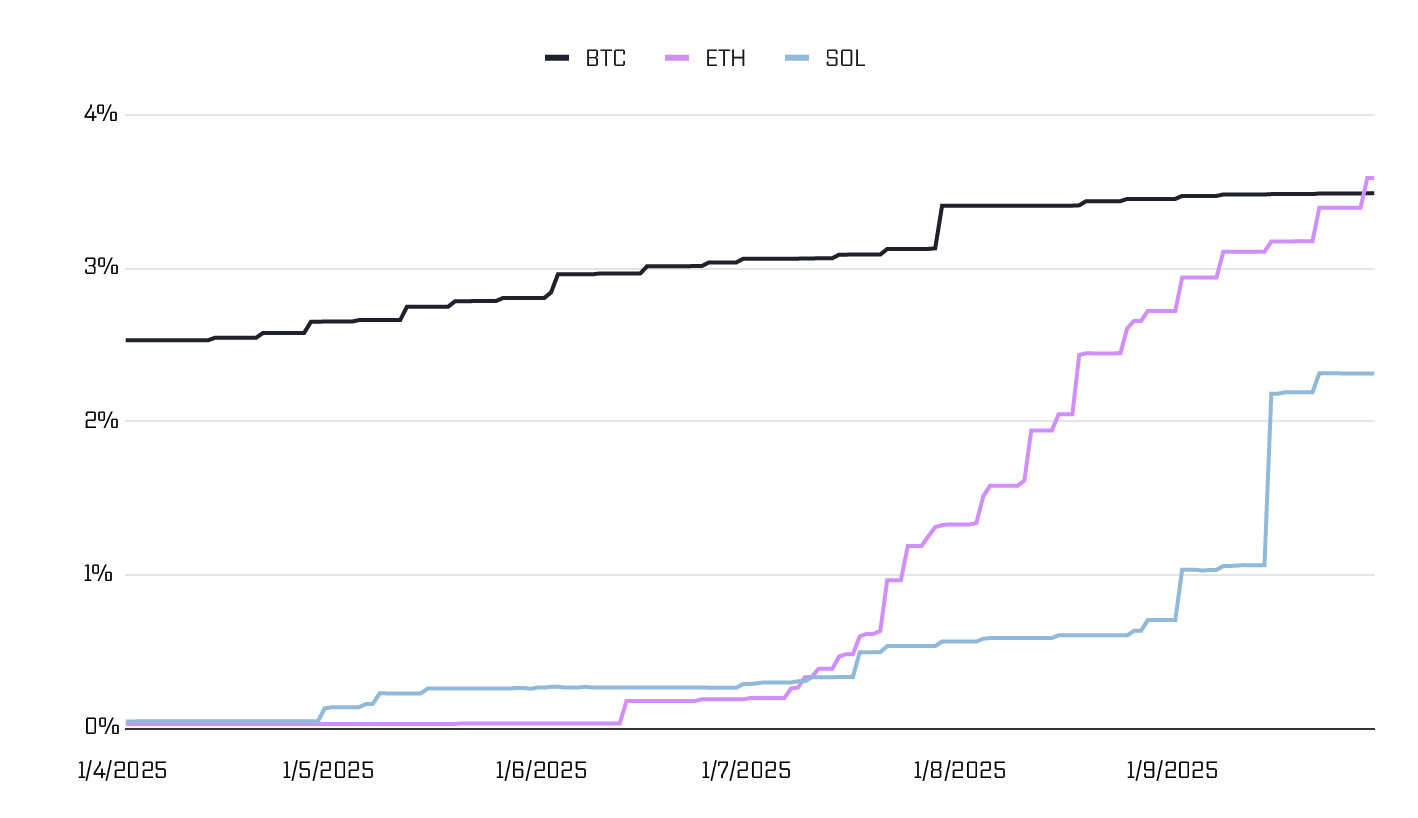

Percentage of total supply held by DATs for major cryptocurrencies has increased sharply over Q3 (Source: Blockworks)

Their rise bridged the gap between retail speculation and institutional allocation, offering investors exposure to altcoins still awaiting ETF or ETP approval and, in some cases, leveraged access to those that already had one. For reference, by late August the number of active DATs had climbed above 180––nearly double the count from early summer––and their combined market capitalization exceeded $115 billion.

Average premium to mNAV of Digital Asset Treasuries has recently compressed (Source: Blockworks)

As September approached, however, the reflexivity that had powered them began to unwind, as markets grew uneasy leading up to the FOMC meeting. mNAVs, which had traded at substantial premiums through July and early August, compressed sharply toward parity, and several smaller DATs slipped below the value of their underlying reserves. With premiums gone, their ability to issue new shares and recycle proceeds into token accumulation effectively stalled. In a few cases, even existing reserves had been largely deployed, leaving limited incremental buying power to sustain a floor for the market.

Nonetheless, the significance of DATs remains intact. Their temporary exhaustion was less a flaw in the model than a reflection of the market’s transition into caution. Should conviction return and macro conditions stabilize, these vehicles are positioned to reawaken with the same reflexive force—perhaps even greater than before.

The return of two-way markets

September opened with markets’ focus squarely on the Fed. Chair Powell’s Jackson Hole speech had made clear that the path to easing was open but conditional, turning attention from inflation to labor data as the deciding factor. That shift carried the market’s rhythm from August, where each payroll print, jobless-claims release, and wage indicator became a referendum on policy timing, with investors calibrating positioning against every incremental sign of labour cooling. By the second week of the month, evidence had accumulated that the labour market was indeed losing steam, and a 25-basis-point cut was fully priced into the FOMC meeting.

When the decision to cut arrived, it confirmed the transition to a new regime. The Fed delivered its first rate cut of the cycle, describing it not as a reaction to stress but as a “risk-management” move aimed at sustaining the expansion. That framing mattered; it signalled the beginning of an easing cycle, but one that would unfold gradually. With the cut now behind them, investors shifted from anticipating the move to interpreting its pace. Equities, extended after months of steady gains, wavered as yields rebounded and the dollar regained strength, reflecting concern that the Fed’s caution meant additional support would come slowly.

The same uncertainty that unsettled equities was felt in amplified form in crypto, where it cascaded through leveraged positions, triggering nearly $1 billion in liquidations overnight on September 22, which marked the largest unwind of the year to that point. Majors, such as Ethereum and Solana, led the decline before stabilising, while DAT mNAVs compressed further as issuance paused. The combination of weaker majors and DAT premium compression extended pressure to the broader market, driving a sharp sell-off in altcoins before a tentative recovery set in.

The easing cycle and the debasement trade

Behind the volatility, September also marked the beginning of a deeper pivot: U.S. monetary policy is now entering its first coordinated easing phase in nearly four years. By shifting its balance between inflation and employment at the Jackson Hole meeting in August, Powell has effectively restored the spirit of the Fed’s “Flexible Average Inflation Targeting” framework that allows inflation to run modestly above target to preserve labour market strength. In doing so, it revived the broader four-year blueprint that treats full employment and price stability as co-equal goals.

And that shift carries far-reaching implications. Central banks are again willing to tolerate moderate inflation to sustain growth, while fiscal authorities globally show little appetite for restraint. This renewed alignment between monetary and fiscal policy has brought the global debasement narrative squarely back into focus. Mounting debt levels and persistent deficits are testing confidence in the discipline of fiat currencies, and investors are responding in familiar ways. Long-dated sovereign yields began to roll over in September, the dollar has softened on a longer horizon, and global money supply is expanding as liquidity returns across major economies. Consequently, the pivot in price action has been an unmistakable rotation toward hard assets as stores of value.

Gold, in particular, has been on an extraordinary run as the clearest manifestation of this theme. After years of consolidation, it has surged to successive record highs and broke $4000 for the first time in October, with momentum now fuelled by the same combination of fiscal excess, negative real yields, and institutional allocation that defined previous easing cycles. That strength, in turn, has lifted the psychological ceiling for Bitcoin, reinforcing its role as the higher-beta expression of the same store-of-value trade. Historically, major gold rallies have tended to precede capital rotation into digital assets, as investors recycle gains from the metal into instruments offering greater convexity to the same underlying thesis. With gold’s parabolic move still unfolding, expectations are building that capital rotation into Bitcoin may follow, especially as liquidity conditions continue to ease and macro uncertainty keeps the debasement narrative alive.

Looking forward: the new phase of the cycle

As Q3 ends, the setup for digital assets remains distinctly constructive. The Fed’s first rate cut has confirmed the start of the easing cycle, with two more likely before year-end and futures already pricing over 125 basis points of additional easing through 2026. Growth is moderating, inflation expectations remain anchored, and global liquidity is turning higher.

Structurally, the path ahead looks stronger than ever. Legislative breakthroughs have removed the last institutional barriers, Solana ETFs are expected to launch in early Q4, and filings for other leading altcoin ETFs are underway. Meanwhile, digital-asset treasuries continue to expand, hard-wiring structural demand into the market.

Despite this supportive backdrop, the evening of October 10 brought the largest deleveraging in crypto’s history that shook investors’ conviction. Within twelve hours, over $19 billion in long positions were liquidated, marking the worst cascading event ever in crypto markets. The crash was triggered by a surprise tariff shock on China, which ignited panic in an overleverage-laden market, and then amplified by structural fragilities (thin liquidity, auto-deleverage protocols, feedback loops). Yet even this reset proved orderly and ultimately healthy: major assets have since stabilised, funding has normalised, and capital has rotated toward projects with credible fundamentals. The rebound has been led by majors and high-quality DeFi / infrastructure names, suggesting the market is consolidating around credibility over leverage.

With that in mind, September’s shock was less an end than a clearing of the field. What has followed in days since is the kind of resilience that defines lasting cycles, where a test of confidence strips away the excess and rewards strength. As Q4 begins, liquidity is improving, policy is making strides to expand the traditional markets’ bid, and capital is flowing back to quality. The next phase will therefore not be driven by leverage, but rather by long-term conviction.